FrankJScott

Dołączył: 26 Sie 2022

Posty: 24

Skąd: Best Mastiff Breeds

|

Wysłany: Pon Sty 16, 2023 09:25 Temat postu: Best Ideas For Deciding On Trade RSI Divergence Wysłany: Pon Sty 16, 2023 09:25 Temat postu: Best Ideas For Deciding On Trade RSI Divergence |

|

|

4 Best Reasons For Picking An RSI Divergence Strategy?

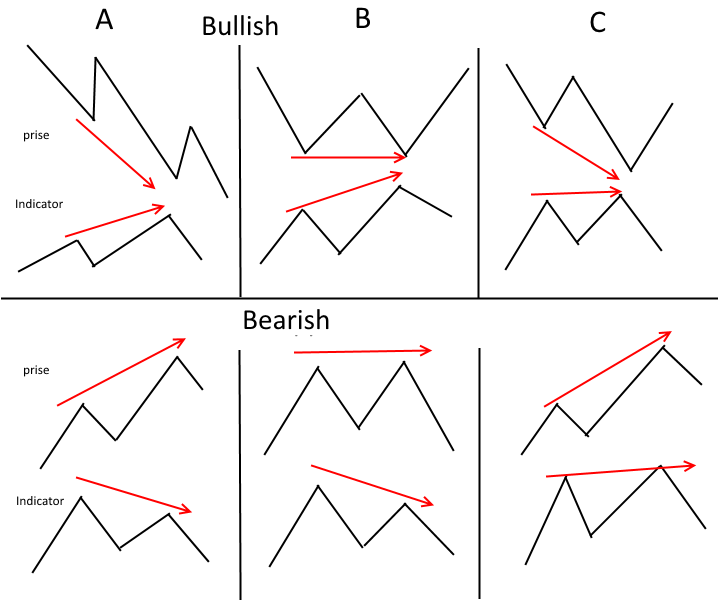

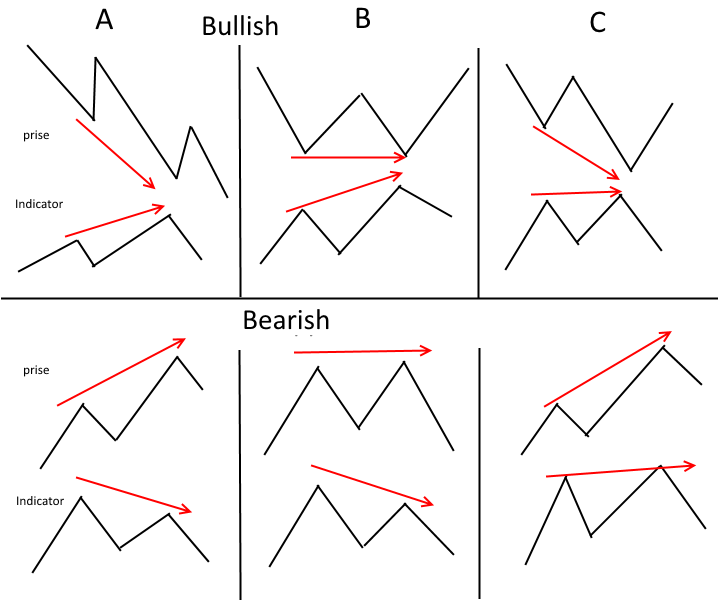

Let's start with the most obvious question. We'll explore the meaning of RSI Divergence actually is and what trading insights we can get from it. If your price action or RSI indicator is not in sync on your chart, it is an underlying divergence. In other words, when RSI and the price action are not in sync, a divergence occurs on the chart. In a market with a downward trend the price will make lower highs, while the RSI indicator creates a higher low. A divergence happens the case when an indicator isn't in agreement with the price action. This should be an indicator that you should keep an eye on the market. Both the bullish RSI and the bearish RSI divergence are clearly evident in the chart. The price action was actually reversed by both RSI Divergence signals. Let's move on to the fun topic. View the top rated automated trading platform for more advice including metatrader online, thinkorswim automated trading, trader joe's crypto, forex trading hours, cheapest crypto trading platform, best crypto platform for day trading, webull fees for crypto, binance auto trader, best platform to trade crypto, ally automated investing, and more.

How Do You Analyze Rsi Divergence

We are using RSI to identify trend reversals. This is why it is essential to recognize the correct one.

How To Identify Rsi Divergence In Forex Trading

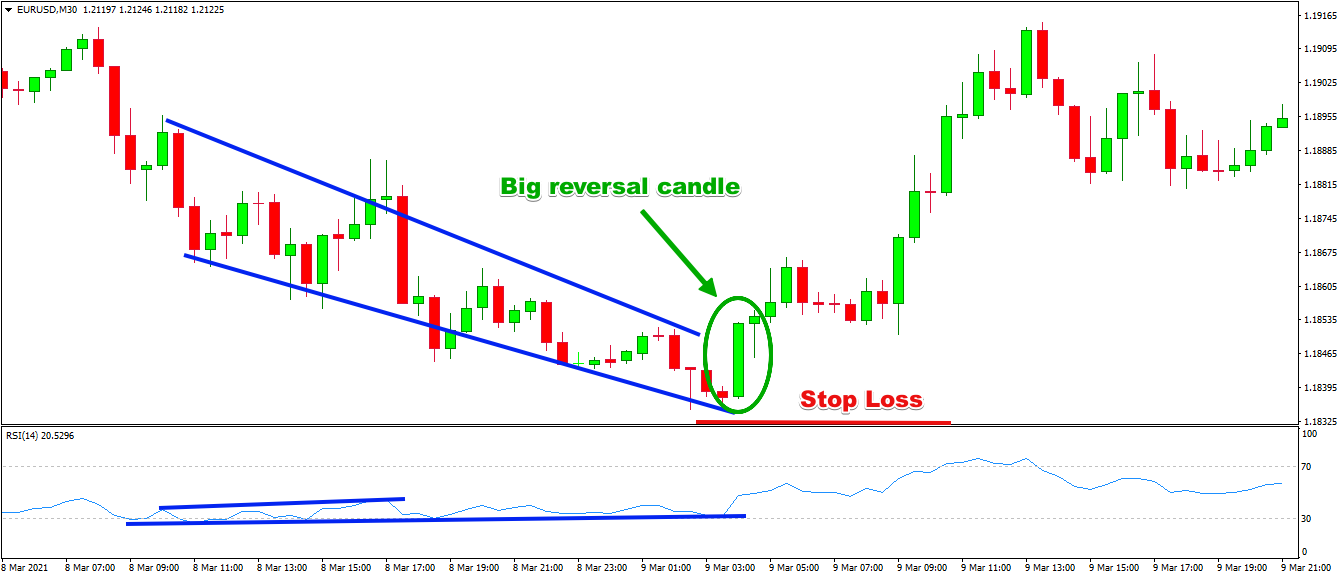

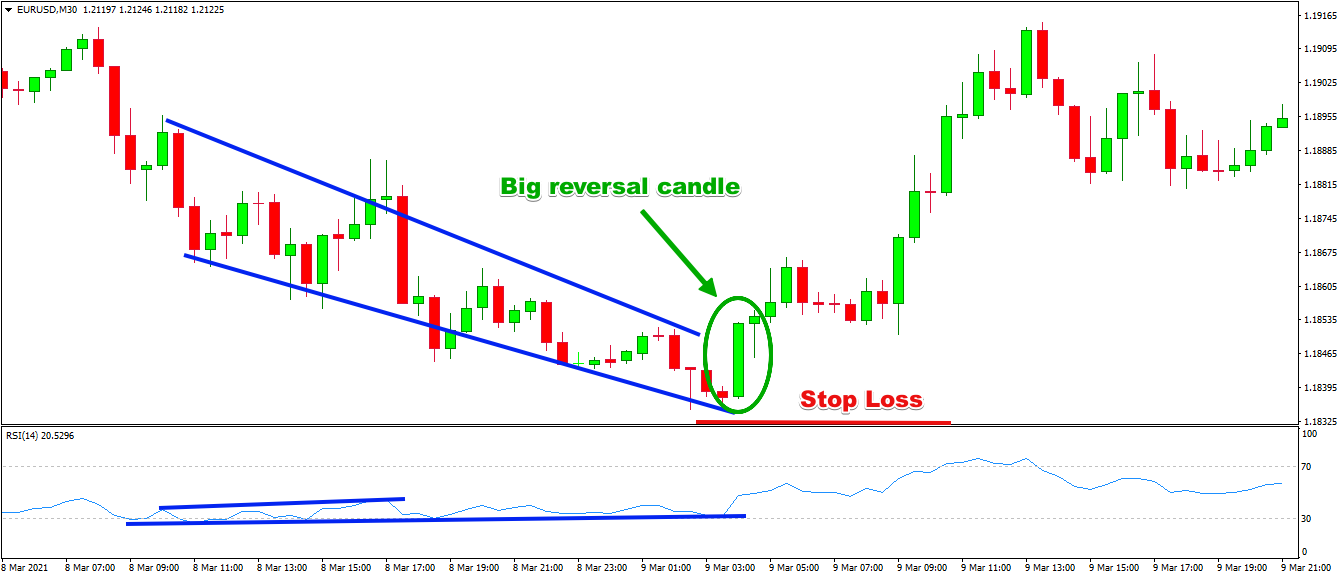

Both Price Action and RSI indicators both formed higher highs at the start of the trend up. This indicates that the trend is stable. In the final phase of the trend, price makes higher highs and the RSI indicator creates lower highs. This means that there are things worth monitoring in this chart. This is when we need be watching the market as the indicator as well as the price action are out sync. It means that there's an RSI deviation. In this example, the RSI diversgence is indicative of the bearish trend. Take a look at the graph above and note what happened after the RSI divergence. It is evident that the RSI divigence is very accurate in identifying trend reversals. The question is: what is the best way to detect the trend reversal, right? Let's discuss 4 trade entry strategies that provide higher probability of entry when combined with RSI divergence. Take a look at recommended divergence trading for more tips including automated technical analysis, best trading platform for automated trading, crypto swap exchange, leverage crypto, best ecn forex brokers, robot for trading stocks, automated trading, tradeviewforex, reddit day trading crypto, forex auto trading software, and more.

Tip #1 Combining RSI Divergence with the Triangle Pattern

Triangle chart pattern comes in two variants. It is one of Ascending triangular pattern that is useful in a downtrend. The other is the descending triangle pattern that can be used as a reversal when the market is in an uptrend. Take a look below at the pattern of descending triangular as shown in the forex chart. Like the previous example above it was in an uptrend before the price fell. At the same time, RSI also signals the divergence. These indicators point to the weakness of this upward trend. We can see that the trend is losing momentum. The price has formed a descending triangle pattern as a result. This confirms that there was an inverse. It's time for the short trade. Like the previous trade, we used the same breakout strategies to execute this trade too. Now let's move to the third method of trading entry. We'll pair trend structure and RSI divergence. Learn to trade RSI Divergence whenever trend structure shifts. Have a look at the recommended forex tester for website examples including best crypto trading site, pionex fees, europefx automated trading, ftmo trading, crypto arbitrage trading, crypto platform with lowest fees, 3commas indicators, fxhours, binance futures trading fees, vertexfx, and more.

Tip #2 Combining RSI Divergence with the Head and Shoulders Pattern

RSI diversification can be a valuable instrument for traders in forex to identify market reverses. You can improve the probability of your trade by using RSI diversence with other reversal factor like the Head-and-shoulders pattern. Let's examine how we can time trades by using RSI diversence along with the Head and Shoulders pattern. Related: How to Trade the Head and Shoulders pattern in Forex. A Reversal Trading strategy. A stable market is essential before we can look at trading. Since we're trying to find a trend reversal, It is better to have a trending market. The chart is below. Read the best divergence trading forex for site advice including cryptotraders, best automated futures trading software, forex ea robot, best app for buying crypto, tastyworks automated trading, investopedia forex, forex algorithm software, ftmo funded account, fully automated trading bot, best coin trading platform, and more.

Tip #3 Combining RSI Divergence and Trend Structure

The trend is our good friend. Trading should be done in the direction of the trend as long the market is in a downward trend. This is what professionals teach. But, the trend is not going to last for a long time. At some point it will reverse. Let's examine trend structure, RSI Divergence , and how to spot those Reversals. You've probably noticed that the trend upward is creating higher highs while the downward trend is creating lower bottoms. Check out this chart. If you take a look at the chart to the left, you'll see that it's a downward trend. It shows a series of lows as well as higher highs. Next, take a look at "Red Line" which shows the RSI divergence. The price action is what creates lows, however the RSI creates lower lows. What does this indicate? Even though the market creates lows, the RSI is doing the exact opposite thing this indicates ongoing downward trend is losing its momentum and we should prepare for a reverse. Have a look at the top software for automated trading for website tips including best quadency bot, auto trade tradingview, livecharts forex, etrade cryptocurrency, ftmo ctrader, bookmap crypto, forex info, top forex robot 2020, best crypto trading platform reddit, automated trading sites, and more.

Tip #4 Combining Rsi Divergence In Combination With The Double Top & Double Bottom

Double tops, also known as double bottom, is a reverse trend that occurs after an extended movement. Double tops occur when the price is at an unbreakable threshold. The price will begin to retrace after hitting this level , but after that it will retest the previous levels. If it bounces back from the level, you'll be in a double top. Below is an example of a double top. The double top shows double top that both tops were created following a powerful move. Note how the second top was unable to rise above the previous top. This could be a sign of reverse. It's telling investors that they have a hard time climbing higher. The double bottom uses the same principles, but in a different manner. In here we use the technique of breakout entry. We execute selling when the price drops below the threshold. The price surpassed our take profit within less than a day. QUICK PROFIT. The double bottom is traded with the same methods. Below is a graph which explains the best way you can trade RSI diversgence using double top.

This isn't the ideal trading strategy. There isn't a single trading strategy that is ideal. Every strategy for trading has losses. While we earn consistent profits with this trading strategy We also employ a strict risk management and a quick way to cut down the losses. This will enable us to cut down on drawdowns as well as open the doors to huge upside potential. Read more- Recommended Ideas For Choosing Trade RSI Divergence 1626_64 , Great Hints For Deciding On Trade RSI Divergence and Best Ideas For Picking Trade RSI Divergence.

_________________

Google it! |

|